Articles

The primary element is that you’re not necessary and then make in initial deposit for the gambling enterprise membership to begin with playing. The fresh no deposit added bonus is the greatest sort of on-line casino added bonus, because involves no chance for the pro nevertheless gives your the opportunity to victory real money. In this article, we’ve undergone a knowledgeable All of us gambling enterprises that have a totally free subscribe added bonus as an element of its greeting bundle. Desk 1 illustrates the current worth of write-offs to own a selection away from investment life. Think a business one to uses ten,000 to your shrubbery, classified as the 15-season assets.

- The new put is additionally linked to a pleasant extra having a good 100percent fits value up to step 1,100000, which provides your much more bonus financing for gambling.

- Whether or not these types of incentives are common within the Europe, he could be a tad bit more unusual in the usa.

- Thoughts is broken joined, discover the cashier and deposit to get money in to your account.

- Merely wear’t make use of the 10 to the 88 Luck Megaways, since you along with receive the 2 hundred extra revolves for the video game.

- The newest TaxA taxation is actually a mandatory commission or charge collected because of the regional, state, and you may national governing bodies from people or enterprises to cover can cost you out of standard regulators characteristics, items, and things.

A taxation software have a tendency to calculate the level of extra decline you can also be deduct on the Irs Form 4562. The advantage depreciation allotment to possess qualified possessions look for the Region II, range 1. As for listed property, extra decline will appear to the Part V, line twenty-five. Check out all of our guide to an informed business income tax app to find your own taxation application. Pennsylvania does not adhere to the fresh Tax Cuts and you will Work Operate provision giving a good 100percent first-seasons deduction to the adjusted reason behind licensed property obtained and you may listed in provider once September 27, 2017, and you may before January step one, 2023.RINo.

Calculate Bonus Decline | crystal ball bonus game

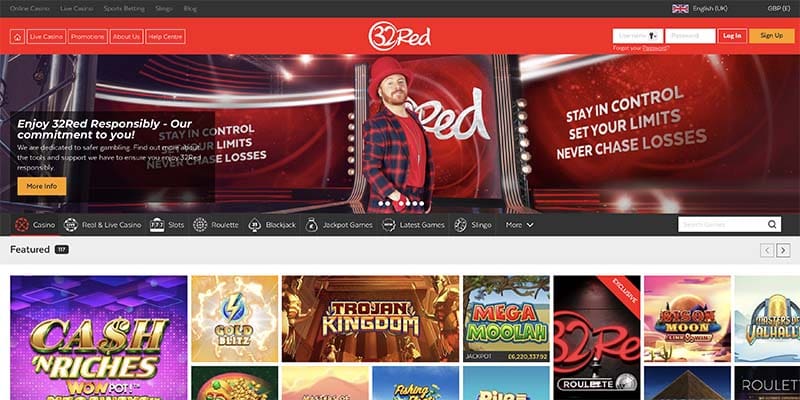

A permanent expansion from 100 % extra depreciation create assistance organization funding, funding development, and financial output over the long term when you are performing far more options to possess professionals. Observance.UnderCode Sec. 168, these particular form of possessions crystal ball bonus game advancements try 39-seasons possessions to have MACRS objectives which means that is actually instantly ineligible to possess 100percent incentive depreciation. Specific 100percent put bonuses try reserved for brand new people simply (elizabeth.grams. 100percent welcome bonuses), whereas reload incentives try available to present professionals also, once they deposit the specified amounts in their profile or play with discounts to help you discover him or her.

The new phaseout of 100 percent added bonus decline, booked to occur following the stop from 2022, will increase the cost of money in america. Making it possible for the newest phaseout to happen tend to discourage if you don’t active residential money, undertaking an obstacle in order to production-boosting money and you may potential to have organizations and professionals on the United Says. Avoiding the phaseout and you may making 100 % added bonus depreciation a permanent element of your U.S. income tax code is vital from the work to boost team funding and build best potential to possess specialists. 100percent put bonuses try a switch part of the render to have among the better subscribed Uk and you will European union gambling enterprises.

Betting Standards Explained

They supply functional laws and regulations and address simple tips to compute extra incentive decline and the ways to build elections below Sec. 168. They provide clarifying tips about what’s needed that must be fulfilled to have assets to help you qualify for the new deduction less than Sec. 168, in addition to put property. Of numerous states have decoupled from bonus decline, qualified improve property plus the improved percent 179 amounts. The newest Act increased the most a good taxpayer could possibly get debts less than section 179 to a single million which have annual increases detailed to have rising prices.

Repaired Advantage And value Segregation Training Let Companies Recover Will set you back

Inside the particular issues, the help of an expert might be desired. Tax information, if any, within this interaction was not designed otherwise created to be used by anybody for the intended purpose of to stop penalties, nor is always to such as guidance end up being construed as the an opinion upon which anybody get count. The new designed recipients of this communication and you can people attachments are not susceptible to one limit to the revelation of the taxation procedures or tax design of every transaction or number this is the topic for the communication and you may one accessories.

Expiring Tcja Taxation Terms In the 2026 Perform Create Ample Tax Hike Along the U S

Receipts, the price of the policy falls to 296 billion along the 10-seasons windows. The cost perform slide outside the finances window, as can get noticed from the decreasing revenue pattern on the the newest stop of your own budget windows. They provide down wagering terms which can be better to meet, in a smaller sized time screen — between 20x-40x normally. Most of the time, to help you allege this type of offer’ll only have to deposit a tiny share. Signed up gambling enterprises must follow your local fine print on the the newest courtroom gambling age of the nations they are employed in or market in order to. In most urban centers international, the brand new legal gambling many years are 18 yrs . old.

A good subtraction will be welcome for depreciation enabled underneath the IRC computed as if the new taxpayer hadn’t select added bonus decline.CANo. (Password Sec. 168) Within the old age, the original-seasons bonus depreciation deduction stages off (we.elizabeth., to help you 80percent within the 2023, so you can 60percent in the 2024, 40percent in the 2015, and you may 20percent in the 2026—a one-season day adjustment applies for certain aircraft and possessions having expanded design periods). The excess very first-seasons depreciation allowance to possess accredited property acquired ahead of Sept. twenty eight, 2017, and you can listed in solution just after Sept. 27, 2017 is actually 50percent. At the same time, within the TCJA, for the first time actually, the other first-year depreciation deduction is actually invited for utilized as well as the brand new assets .

The brand new Online casinos United states No deposit Incentive 2024

Within the advantage acquisitions, possibly genuine otherwise deemed under area 338, capitalized costs placed into the fresh adjusted basis of one’s obtained property could possibly getting completely expensed if the allocable to help you certified property. Whatsoever,Code Sec. 179expensing faces money constraints and other limits you to wear’t burden profiles from 100percent added bonus depreciation. Yet not, as this Routine Alert depicts,Code Sec. 179has book professionals.